How Managing Accounts Payable Strategically Maximizes Cash Flow

After two years of defensive financial measures, businesses are ready to grow again.

Posts by

Steve is a seasoned financial professional with over 35 years of experience working with financial processing and technical platforms. He is currently responsible for providing client-focused solutions to automate large enterprise organizations' accounting, finance, and treasury functions using ActiveWorx, a cloud-deployed business process automation platform. Before his current role, he held senior roles with FIS/SunGard, SEI Investments, Delaware Investments, and EY. He is a Pennsylvania CPA and graduated from LaSalle University in Philadelphia with a BS in Accounting & Finance. He splits his time between the Philadelphia area, the Jersey Shore, and South Carolina.

After two years of defensive financial measures, businesses are ready to grow again.

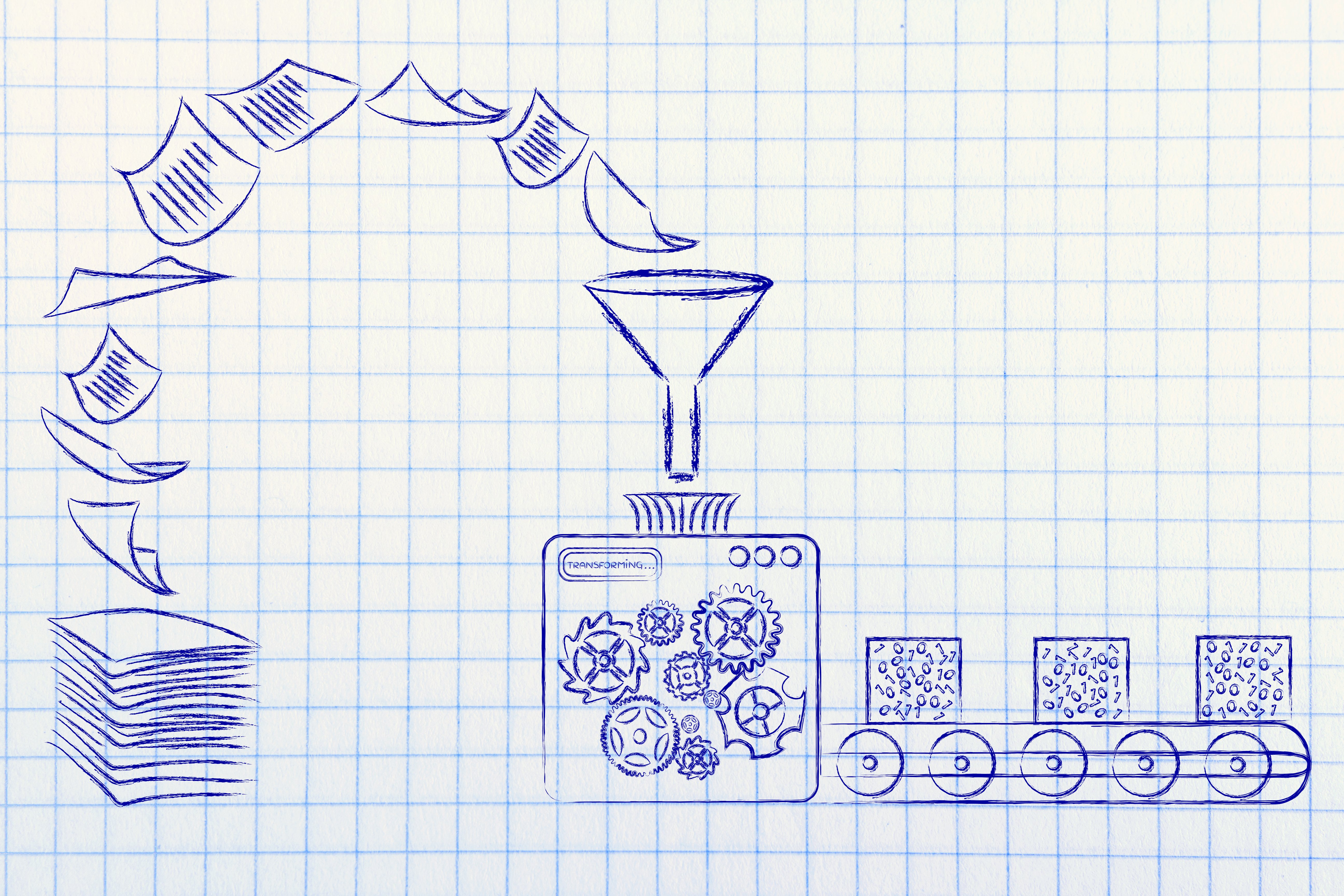

Accounts payable (AP) leaders have long dreamed of the day when invoices arrived electronically.

My takeaways from the APP2P Conference & Expo in Denver

When your organization uses multiple ERPs, it can certainly be a big inconvenience. You and your managers know it’s frustrating. It takes a lot of time for your employees to enter data manually and every report must be created separately.

When your organization uses multiple ERPs, it can certainly be a big inconvenience. You and your managers know it’s frustrating. It takes a lot of time for your employees to enter data manually and every report must be created separately.

It’s hard to put a price on time. But occasionally, you know what it costs you. Like you when you take your car to a mechanic and they fix something that would have taken you hours, maybe days. Even if you know you can do it, is it really the best use of your time?